When I started off with travel credit cards, the one thing that concerned me most was paying an annual fee on a credit card, it just did not make any sense to me at the time. Once I started to do a bit more research though, I began to realize that a lot of these travel credit cards give you plenty of opportunities to earn back the annual fee every year. One of those opportunities is by providing a travel credit to be used each year you have the credit card.

Since it is the beginning of a new year, I thought it would be the perfect time to review the annual travel credits you can get from credit cards with the big four transferable point systems American Express, Capital One, Chase and Citi. go into the basics of which cards provide an annual credit, since not every credit card offers the same amount of credit and each credit card issuer has slightly different rules on how to use them.

I am going to go through each one and highlight which credit cards offer what credits in each system, starting with my favorite.

CHASE

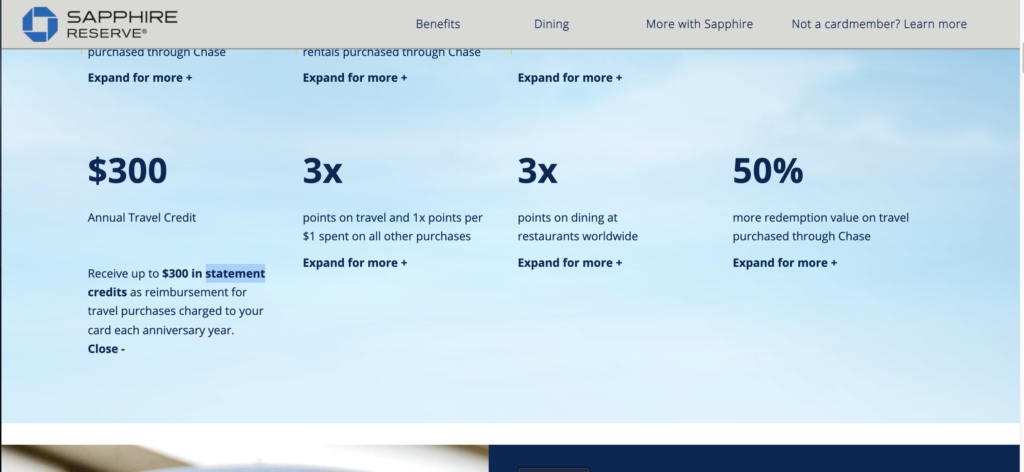

The premium Chase Sapphire Reserve is the one Chase credit card which offers an annual travel credit, but in my opinion it is by far the easiest to use. While the annual fee for the Sapphire Reserve now sits at $550 annually, the $300 annual travel credit makes up for over half of that annual fee. Once you start to add in the other perks which we will talk about in a separate posti, you can see how easy it becomes to make up for that annual fee.

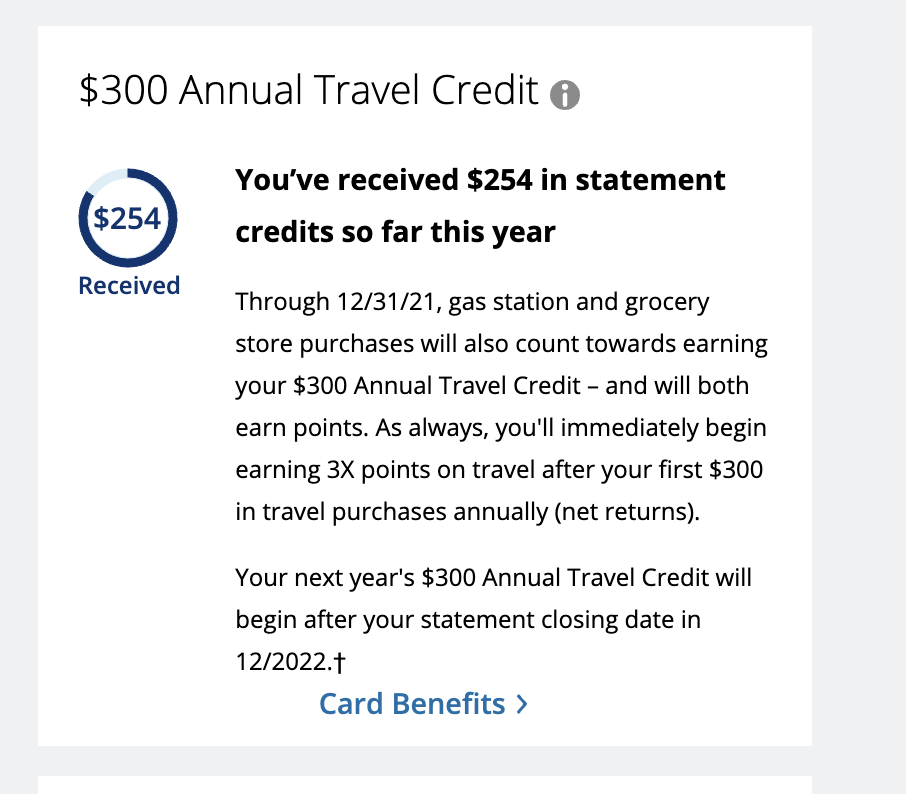

The travel credit for Chase resets after your December account statement closes each year, so if the statement closes December 5, you could have started to use your 2022 travel credit on December 6, 2021. After that date you can use your Chase travel credit on essentially any travel purchase, except for gas for your car and Chase will apply the credit automatically within a few days of the purchase posting to your account. Whether it is a flight, hotel, airbnb or even your subway ride in New York City, the travel credit on the Sapphire Reserve will cover it and reimburse you. The best part? You do not even have to use the full $300 at once, you can make as many purchases as you want up to the $300 amount.

The one thing to note though, you will not earn any Chase Ultimate Rewards points on your purchases which are reimbursed through the Chase travel credit, unlike the next credit card.

CAPITAL ONE

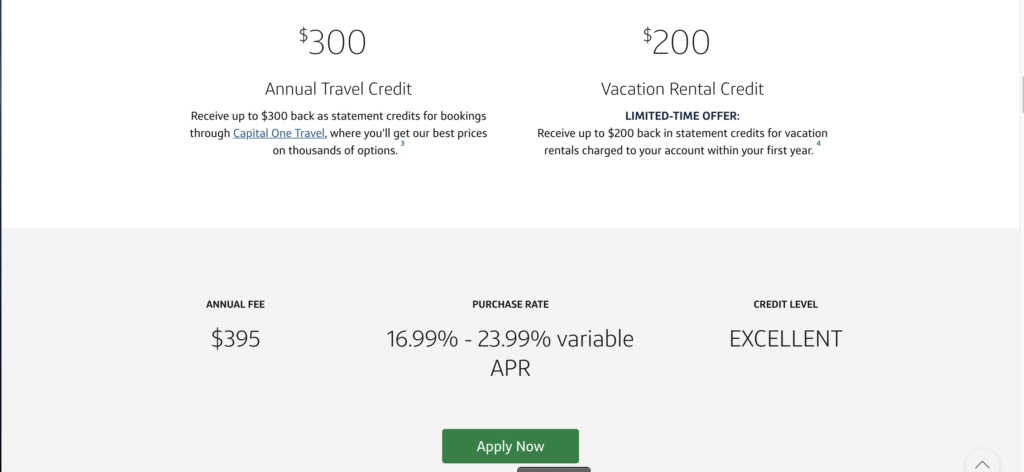

Capital One is the new kid on the block when it comes to transferable points. They originally introduced the Capital One Venture card as a travel cash back card of sorts and was the perfect credit card to wipe out a big travel expense like a Maldives seaplane transfer. That all changed recently and to up the ante, Capital One introduced the Venture X, their premium level travel card to compete with Chase and American Express. The Venture X has a much more manageable annual fee of $395, but matches the Sapphire Reserve with a $300 annual travel credit, which covers most of that fee… talk about value.

While the Venture X card is still new and I am unsure how the reset will work in practice, you will receive the $300 each new card member year, so it will depend upon when you sign up for when your credit will reset. Unfortunately, unlike Chase you are restricted to using the annual travel credit through the Venture X travel portal, which is slightly disappointing as I really like the freedom (pun intended?) Chase provides. This means with the Capital One card you cannot use it for a subway or bus ride, but compared to American Express, it is still relatively easy to use. You can also use it in increments like the Chase card up to $300. I used mine this year to book two separate flights and wound up paying around $50 out of pocket for them.

Right now if you sign up for the Venture X card, you actually get an additional $200 credit to be used on Airbnb or other vacation rentals during your first year with the credit card, it is basically like Capital One is paying you to have this credit card! In practice I noticed this credit even wound up working on a hotel stay I booked, so it does not seem to be hard coded to only work on vacation rentals, making this even more valuable. On top of that you do not need to book through the travel portal for this credit to apply, so it is similar to the Chase credit. That said, the expectation is that this is likely a one time credit that will not be returning after your initial year with the credit card.

Finally, unlike the Chase card though, with the Venture X you will earn any Venture card points on your purchases and since you are making them through the Capital One travel portal, you will do so at enhanced rates of 10 points per dollar spent at hotels or 5 points per dollar spent on airfare, which is a sweet added perk. If it was not for the restriction of using the $300 travel credit through the Capital One portal, it would definitely be my favorite annual travel credit.

AMERICAN EXPRESS

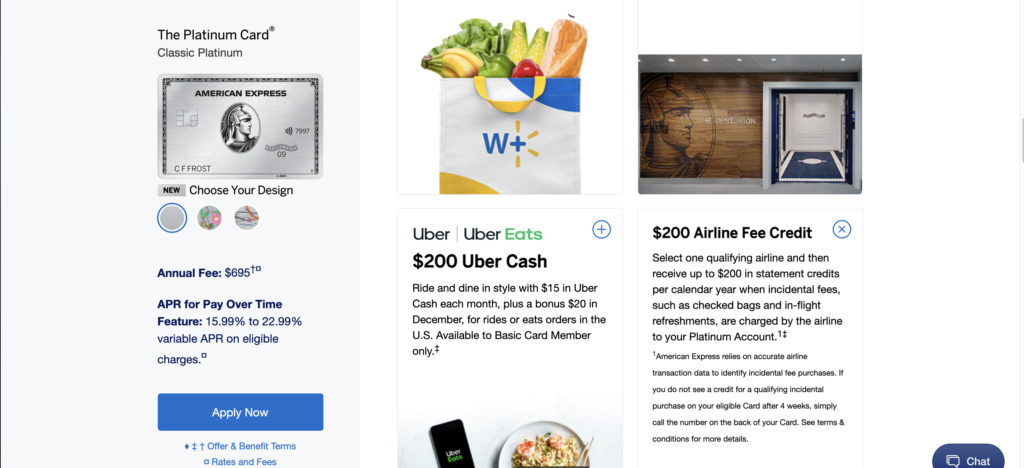

American Express actually has the most credit cards with an annual travel or similar credit and some even have multiple credits. Unfortunately though American Express puts the most restrictions on their travel credits, which is why they sit third in my personal ranking for annual travel credits.

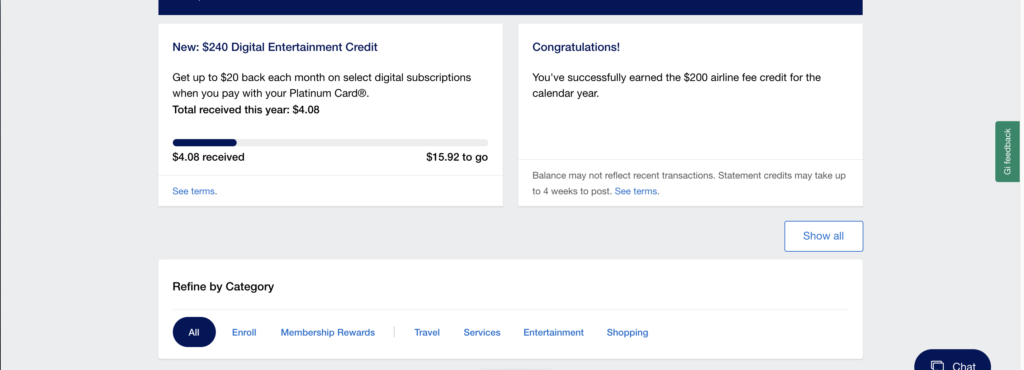

Starting with the premium Platinum card with its $695 annual fee, you have three separate $200 annual credits, one for flights, one for hotels and one for Uber, which is great since it nearly covers the $695 annual fee, but American Express certainly makes you earn those credits. The $200 hotel credit? You need to make a prepaid hotel booking at one of Amex’s Fine Hotels and Resorts or Hotel Collection properties. The Uber credit? It is broken up monthly to $15 or $35 in December and is limited to Uber in the US, though at least you can also use it for Uber Eats.

Finally, the $200 airline credit is probably Amex’s most frustrating credit to use. You must pre-select a US based airline each year and you are only allowed to use it on incidental purchases for that specific airline, meaning checked baggage fees, on board purchases, seat upgrades etc. My way to use this credit in the past (with my Gold card which had a $100 credit) would be to book tickets and then upgrade us to even more space seats on Jetblue flights for a bit of extra comfort. If I had any credit left over I would use it for onboard purchases. There are ways to get a bit more creative in using that credit though, more on that in a bit.

The Amex Gold card offers a similar $120 Uber credit ($10 monthly) as well as a food delivery credit, but removed their $100 airline credit.

The $450 annual fee premium Hilton American Express Aspire credit card offers an annual $250 airline credit, but it has the exact same restrictions as the Platinum card’s annual credit. The Aspire card also offers an annual $250 credit for Hilton hotels, but this also has its restrictions. You can only use it at the 250+ Hilton resorts worldwide and generally speaking you cannot use it for hotel stays. That also has some creative workarounds that we can talk about in a bit. There is also a $100 credit to be used at Conrad and Waldorf Astoria properties as well if you enjoy staying at Hilton’s two high end luxury brands.

Finally the $450 annual fee premium Marriott Bonvoy Brilliant credit card offers a $300 annual credit to be used at any Marriott property worldwide. The great news on this one? It has the least restrictions and can even be used to pay for the room rate of the hotel. I really appreciate that Amex kept this one simple enough. Like the Hilton Aspire card there is also a $100 credit to be used at St. Regis and Ritz Carlton properties if you enjoy staying at Marriott’s two high end luxury brands.

While the credits could be a bit tricky to use, American Express, just like Chase, at least does a good job of displaying a tracker to show how much of the airline credit you have used, but that is one positive compared to all the hoops you have to jump through just to use it in the first place.

CITI

Citi used to sit comfortably in third place with their ThankYou point system, but that has changed with the Capital One Venture X bursting onto the scene. Citi still offers a solid mid tier card with the Premier and you can transfer ThankYou points to Turkish Airlines, which we love, but you can no longer apply for their premium travel credit card, the Prestige.

For those who already have the Prestige though, it continues to have a $250 annual travel credit which is as simple to use as the Chase Sapphire Reserve credit. Even better? It includes gas as a travel purchase, so filling up your tank would be covered up to the first $250 you spend. It sits in last place though due to the fact it is no longer available to new sign ups.

OTHER CREDIT CARDS

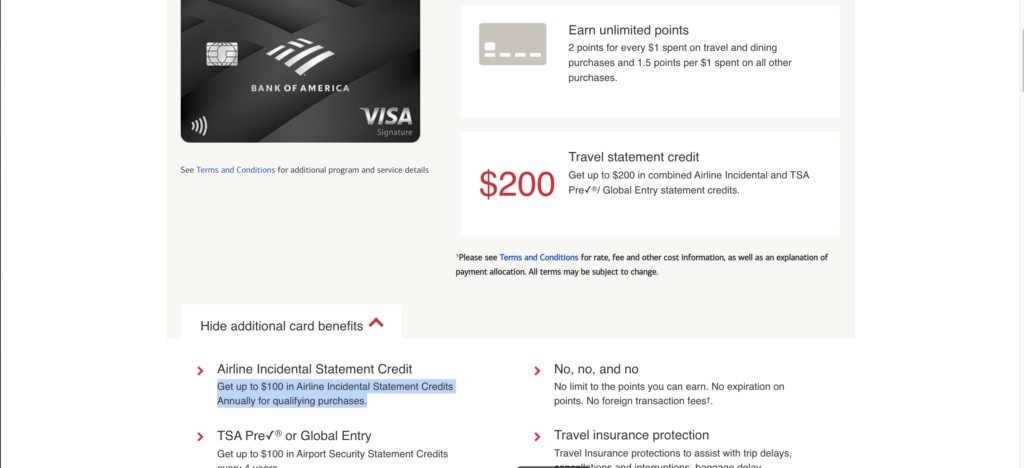

One other thing to note, US Bank and Bank of America also have credit cards which have annual travel credits. I did not include them here because both do not have a transferable points system like the big four credit card issuers, but these cards are perfectly fine travel cards and my current favorite for “wiping out” the Maldives seaplane transfer.

As you can see, most of the credit card issuers make it fairly simple to use your annual travel credit, but American Express makes you jump through a few hoops to really get maximum value. While upgrading yourself to even more space seats is a nice perk, there are some other great ways to really maximize the value of the Amex travel credits. If you are interested in learning more on that, be sure to head over to our Patreon where I detail my favorite use of the Amex travel credits.

If you have any questions or comments on what we talked about here though, please let us know in the comment section below, we would be happy to discuss them with you!